The Buzz on Paul B Insurance Medicare Supplement Agent Huntington

Wiki Article

Paul B Insurance Medicare Advantage Plans Huntington - Questions

As an example, for some measures, in 2022, if the ranking on that particular procedure was less than the previous year, the scores reverted back to the 2021 worth to hold plans safe. An added 2 percent of enrollees are in plans that were not rated because they remain in a plan that is also brand-new or has as well reduced registration to get a rating.

The celebrity scores showed in the figure over are what beneficiaries saw when they selected a Medicare strategy for 2023 and are various than what is used to figure out bonus offer repayments. Over the last few years, Medication, political action committee has raised problems concerning the star ranking system as well as quality incentive program, consisting of that celebrity rankings are reported at the agreement as opposed to the plan level, and might not be a valuable indicator of high quality for beneficiaries because they include also many actions.

Choose a Medicare Supplement plan (Medigap) to cover copayments, coinsurance, deductibles, and various other expenditures not covered by Medicare.

Top Guidelines Of Paul B Insurance Local Medicare Agent Huntington

An HMO might require you to live or operate in its service location to be qualified for protection. HMOs often supply incorporated care as well as emphasis on avoidance as well as health. A sort of strategy where you pay much less if you utilize physicians, hospitals, and other health care service providers that come from the plan's network.

A kind of health and wellness strategy where you pay much less if you utilize carriers in the plan's network. You can use medical professionals, hospitals, and providers outside of the network without a reference for an added cost.

Having an usual resource of care has been found to improve quality as well as minimize unnecessary care. Most of individuals age 65 and older reported having a normal provider or area where they obtain treatment, with somewhat higher prices amongst individuals in Medicare Advantage prepares, people with diabetic issues, as well as individuals with high demands (see Appendix).

What Does Paul B Insurance Medicare Insurance Program Huntington Do?

There were not statistically significant distinctions in the share of older adults in Medicare Benefit intends reporting that they would certainly constantly or usually get an answer concerning a clinical worry the same day they contacted their typical source of care compared to those in typical Medicare (see Appendix). A bigger share of older grownups in Medicare Benefit strategies had a healthcare specialist they can quickly contact in between medical professional sees for advice regarding their wellness problem (information disappointed).

paul b insurance local medicare agent huntingtonEvaluations by the Medicare Payment Advisory Commission (Medication, PAC) have actually shown that, usually, these plans have lower medical loss ratios (suggesting higher revenues) than various other kinds of Medicare Advantage plans. This suggests that insurers' interest in serving these populaces will likely remain to grow. The findings likewise elevates the imperative to analyze these plans separately from various other Medicare Advantage plans in order to make sure premium, fair care.

Particularly, Medicare Advantage enrollees are much more likely than those in conventional Medicare to have a treatment plan, to have someone who assesses their prescriptions, and also to have a regular physician or location of care. By providing this added aid, Medicare Benefit strategies are making it easier for enrollees to get the aid they require to manage their healthcare problems.

Everything about Paul B Insurance Medicare Advantage Plans Huntington

The study results also elevate concerns about whether Medicare Benefit plans are getting suitable payments. Med, special-interest group estimates that strategies are paid 4 percent more than it would set you back to cover comparable individuals in conventional Medicare. On the one hand, Medicare Benefit intends seem to be giving solutions that aid their enrollees handle their care, as well as this added care administration could be of considerable worth to both plan enrollees as well as the Medicare program.

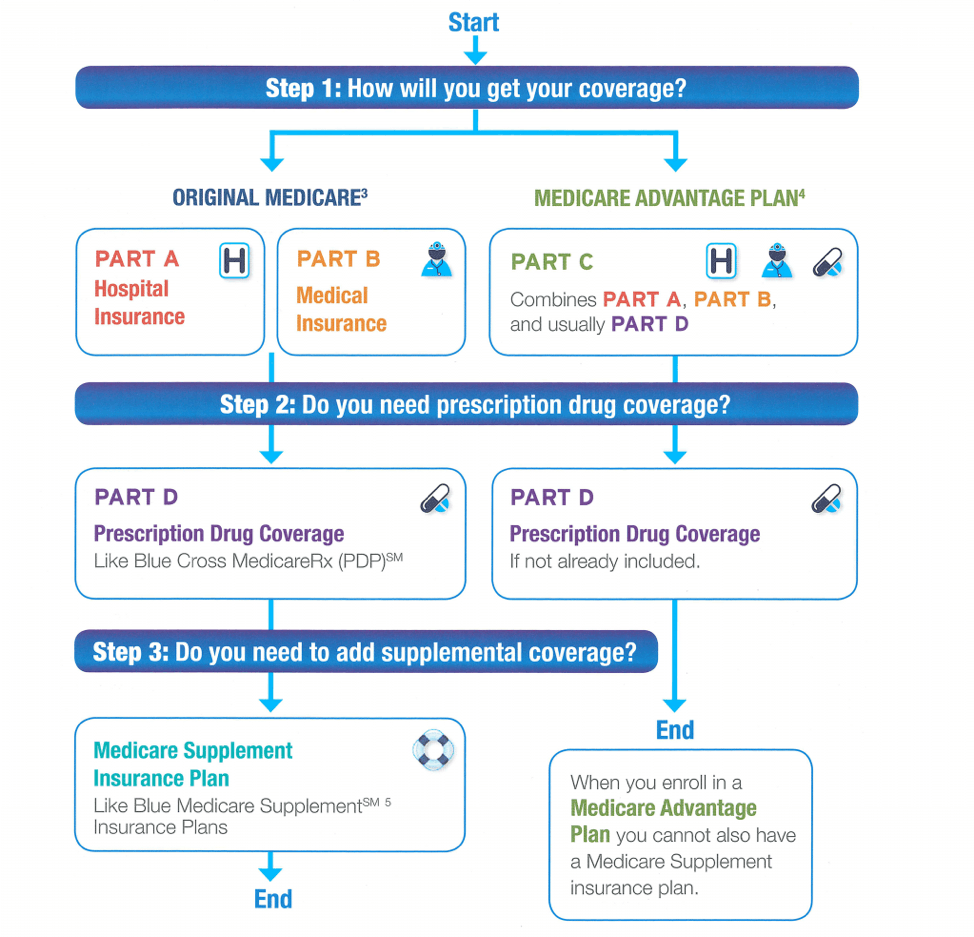

Part An as well as Component B were the very first components of Medicare developed by the federal government. Additionally, the majority of people that do not have extra protection with a group plan (such as those provided by employers) typically sign up for Components An and B at the very same time.

It's composed of plans approved by Medicare that are used with exclusive insurance business. Prior to enlisting in a Medicare Benefit plan, you'll need to enroll in both Part An and Part B. You can after that pick a Medicare Benefit strategy that's right for you. This indicates that to obtain a Medicare Benefit strategy, you need to join straight with the exclusive insurer that offers the strategy you desire.

Paul B Insurance Medicare Supplement Agent Huntington Fundamentals Explained

The quantity of the costs varies amongst Medicare Advantage strategies. You may additionally have other out-of-pocket expenses, including copayments, coinsurance and deductibles. Medicare Benefit puts a restriction on the quantity you spend for your covered clinical care in a provided year. This restriction is known as an out-of-pocket maximum. Initial Medicare does not have this function.

Some Medicare Advantage plans require you to utilize their network of suppliers. As you discover your alternatives, consider whether you want to proceed seeing your current medical professionals when you make the switch to Medicare.

If you pick to enroll in Original Medicare, you can add prescription drug insurance coverage to your Original Medicare insurance coverage. You can do this by acquiring a stand-alone Component D plan from a personal insurance firm. What Medicare Part D covers: Part D covers prescription drugs. Every Medicare prescription drug strategy has a checklist of medicines that it accepts cover.

Little Known Facts About Paul B Insurance Medicare Supplement Agent Huntington.

What Medicare Supplement plans cover: Medicare Supplement intends assistance manage some out-of-pocket costs that Original Medicare does not cover, consisting of copayments and deductibles. That indicates Medicare Supplement strategies are only readily available to people that are covered by Initial Medicare. If you choose a Medicare Benefit strategy, you're not eligible to purchase a Medicare Supplement strategy.

Report this wiki page